Excitement About Opening Offshore Bank Account

Table of Contents8 Simple Techniques For Opening Offshore Bank AccountThe Opening Offshore Bank Account StatementsThe smart Trick of Opening Offshore Bank Account That Nobody is Talking AboutUnknown Facts About Opening Offshore Bank Account

3%, some offshore financial institutions can obtain upwards of 3-4%, though this may not adequate factor alone to financial institution within the territory, it does tell you that not all financial systems were produced equivalent. 4. Foreign Banks Have a More Secure Banking System, It is very important to make certain your possessions are stored in a Putting your wealth in a safe and secure, and also a lot more significantly, time-tested financial system is very vital.The big industrial financial institutions didn't also come close. Foreign financial institutions are much safer alternative, for one, they call for greater resources gets than many banks in the US and also UK. While many banks in the UK and also US call for roughly only 5% books, many international financial institutions have a much greater resources get ratio such as Belize as well as Cayman Islands which have on ordinary 20% and also 25% respectively (opening offshore bank account).

While several domestic accounts restrict your ability in holding other currency religions, accounts in Hong Kong or Singapore, for example, enable you to have upwards of a dozen currencies to picked from all in simply one account. 8 - opening offshore bank account. Foreign Accounts Provides You Greater Property Protection, It pays to have well-protected financial resources.

A Biased View of Opening Offshore Bank Account

Without any type of accessibility to your possessions, exactly how can you defend yourself in court? Money as well as assets that are kept offshore are much more difficult to seize because foreign federal governments do not have any territory and also as a result can not force financial institutions to do anything. Local courts as well as governments that control them just have actually limited influence.

, that is not too shocking. If you are struck with a claim you can be practically reduced off from all your assets prior to being brought to my blog test.

With an overseas LLC, Limited Firm or Trust fund can offer a step of discretion that can not be found in any type of individual domestic account., the CRS and also the OECD have actually radically reshaped banking privacy.

Making use of candidate directors can likewise be used to develop an additional layer of protection that eliminates your name from the paperwork. Takeaway, It is never ever as well late to develop a Plan B.

10 Easy Facts About Opening Offshore Bank Account Described

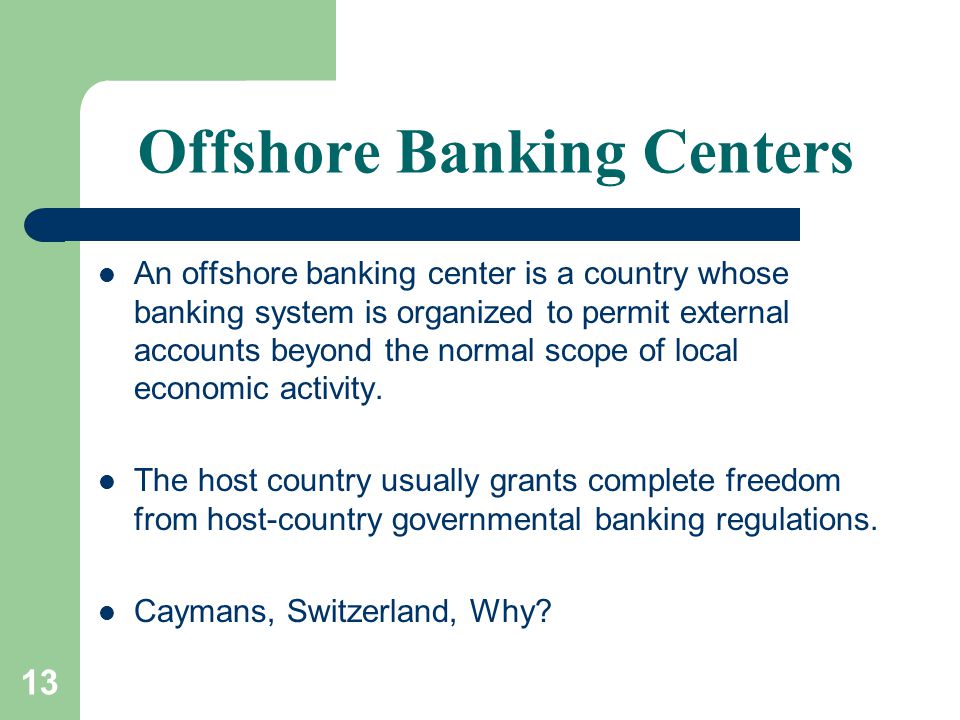

What Is Offshore? The term offshore refers to an area outside of one's home country., financial investments, and deposits.

Raised pressure is leading to even more reporting of foreign accounts to global tax obligation authorities. In order to certify as offshore, the task taking place should be based in a country various other than the firm or investor's residence country.

Offshoring isn't generally illegal. Hiding it is. Special Considerations Offshoring is flawlessly lawful since it supplies entities with a large amount of privacy as well as confidentiality. But authorities Get More Info are concerned that OFCs are being made use of to avoid paying tax obligations. There is enhanced pressure on these countries to report foreign holdings to worldwide tax obligation authorities.

Sorts of Offshoring There are several kinds of offshoring: Organization, investing, as well as financial. We have actually gone into some information regarding how these work below. Offshoring Company Offshoring is typically described as outsourcing when it comes to business task. This is the act of establishing specific business functions, such as manufacturing or phone call facilities, in a country aside from where the business is headquartered.

Not known Incorrect Statements About Opening Offshore Bank Account

Offshore financiers might also be inspected by regulatory authorities and tax authorities to make sure taxes are paid.

This suggests you could be responsible if you don't report your holdings. You should do your due diligence if you're going to invest abroadthe same way you would certainly if you're collaborating with a person at residence. Make certain you choose a trustworthy broker or investment professional to make certain that your cash is managed correctly.